MYOB Acumatica - Financial Year-End Activities

A financial year is closed automatically when you close the last period of this financial year. Thus, you should close the last period of a particular financial year only when the company is ready to close the financial year.

But what are all of the steps to follow for the Year-End?

Click the button below to get in touch. We'll send you the recording and reach out to you to see how we can assist.

MYOB Acumatica - Financial Year-End Activities

It’s that time of year again and once again we are faced with finalising our financial year end. So just what are the processes to not only cover the financial year end activities in Finance but we will also look at payroll year end as well as Warehouse activities.

In MYOB Acumatica a financial year is closed automatically when you close the last period of this financial year. Thus, you should close the last period of a particular financial year only when the company is ready to close the financial year.

We always find that while finalising your year end is not a hugely complex task but it is an important one and not one we practice very often.

MYOB Acumatica Year-End Closing Procedure

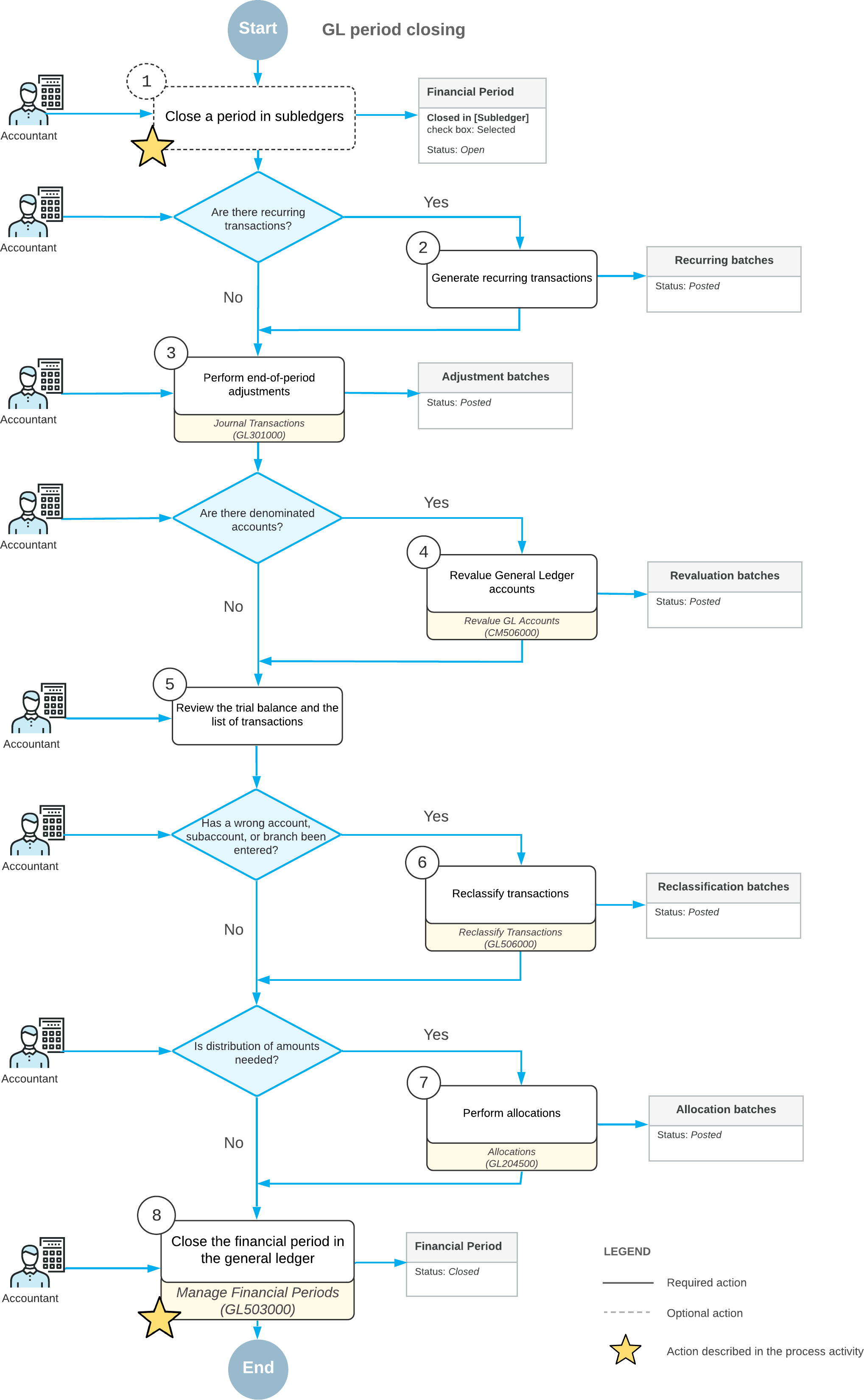

The year-end closing includes the following stages:

1. Generating periods for the new year and opening at least one of these periods, as described in Master Calendar Generation.

2. Carrying out the operations on your company’s year-end checklist.

3. Closing the last period in the general ledger, as described in Closing Financial Periods: To Close a Period in Subledgers and GL.

Balance Update

After you close the financial year, the balances of the balance sheet accounts are simply transferred into the new financial year, while the balances of the temporary accounts are reset to zero. For details on these accounts, see YTD Net Income and Retained Earnings Accounts.

Related Considerations

• Master Calendar Generation

• Financial Periods: Posting Transactions

• Closing Financial Periods: To Close a Period in a Subledger

• Closing Financial Periods: To Close a Period in Subledgers and GL

• YTD Net Income and Retained Earnings Accounts

• Opening Financial Periods

• To Generate Periods for New Financial Years in Master Calendar

The session will give you a step-by-step guide on activities to perform checks and balances as well as the processes to follow to close the year. However each site will have its own configuration aspects to consider so importantly whilst this session gives an indication of what is required please do consider connecting with our team to assist as required by your team. In the meantime! Please join us to review and refresh for the main activities that the majority of sites will require when closing the year!

Agenda - MYOB Acumatica Year End

Accounts Receivables – Closing Activities

- Running the Re Calculate function.

- Ageing Reports.

Accounts Payable – Closing Activities

- Running the Re Calculate function.

- Ageing Reports.

Inventory – Closing Activities

- Running the Re Calculate function.

- Stock Reports.

- Stock Takes.

Finance – Closing Activities

- Running the reports to confirm the module-based reports.

- Confirm all transactions have posted.

- Running the Year End

Payroll – Closing Activities

- Confirm the Pay Item Categories.

- Running the finalisation.

- What happens if something is not correct how do I update this.

When is the event?

Who are the speakers for this event?

Johnathon Keogh together with Franz Munnich will be delighted to take you through this online training on the day!

Will I be able to ask questions?

The online event is set in a webinar format. To avoid distractions and confusions during the event, all attendees will be on mute. However, you will be able to virtually put your hand up for questions or post the questions in the 'Questions' section and we will answer them at the end of the event!

Will I get a recording?

If you are unable to attend live, still register as we’ll send you the recording.